Find your degree

Managing your money in college has always been a struggle, but in the 2020s, it’s harder than ever. The economy is more turbulent, college costs are historically high, and a lot of the old safety nets – like grants and work study – are harder to come by. In this guide, I’ll talk about essential money management tips tailored specifically for college students.

Disclaimer: Online College Plan does not provide financial guidance. This College Student Budgeting Guide is for informational purposes only and should not be considered financial advice. All data and statistics were current at time of publication.

Budgeting and Tracking Expenses

When I was in college two decades ago, scholarship and grants, plus a part-time work-study was enough for me to pay for tuition, fees, and even have a little left over for fun on the weekend.

Sorry to burst your bubble, but it’s not like that anymore. Financial literacy for college students is more important than ever before.

Coming up with a budget is simple on the surface. It’s basically about making a plan for your money so you can manage it better.

- Calculate your income

- List your expenses

- Set spending limits

- Use budgeting tools

Easier said than done!

First, you have to figure out how much money you have coming in each month. This includes things like your job, any financial aid you get, money from your parents, and scholarships.

Next, think about where your money goes. There are two main types of expenses: stuff you really need (like rent, groceries, and tuition) and stuff you want but don’t need (like going out with friends or buying new clothes).

After you know what you’re working with, set limits on how much you can spend in each category. This helps you make sure you have enough for the important stuff and maybe save some for later.

To keep track of your spending, you can use apps or spreadsheets. These tools help you see where your money is going so you can make changes if you need to.

Remember, budgeting is something you do all the time, not just once. It’s about staying on top of your money and making sure you’re using it wisely.

Understanding Credit Scores and Reports

Financial education for university students should include an understanding of credit scores and reports, as they play a crucial role in your financial future. Here’s what money management tips for students you need to know:

- What is a credit score? Your credit score is a numerical representation of your creditworthiness, ranging from 300 to 850, with a higher score indicating lower credit risk.

- How is it calculated? Factors such as payment history, credit utilization, length of credit history, new credit accounts, and credit mix influence your credit score.

- How do I check my credit report? Obtain a free copy of your credit report annually from each of the three major credit bureaus (Equifax, Experian, TransUnion) and review it for errors or fraudulent activity.

- How do I build credit responsibly? Establish good credit habits by paying your bills on time, keeping your credit card balances low, and avoiding excessive debt.

| Credit Score | Status |

|---|---|

| 300-579 | Poor |

| 580-699 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Exceptional |

Understanding credit scores and reports is really important because they affect your ability to borrow money in the future. Here’s what you need to know:

A credit score is like a grade that shows how good you are at managing money you borrow. It’s a number between 300 and 850. The higher your score, the better. A good credit score makes it easier to get loans, like for a car or a house, and it can even affect things like getting a job or renting an apartment.

Your credit score is calculated based on a few things:

- Payment history: Do you pay your bills on time? Late payments can hurt your score.

- Credit utilization: This is how much of your available credit you’re using. Using too much can lower your score.

- Length of credit history: How long have you been borrowing money? Having a longer history can be good for your score.

- New credit accounts: Opening lots of new accounts at once can make you look risky to lenders.

- Credit mix: Having different types of credit, like credit cards and loans, can be good for your score.

You should check your credit report regularly to make sure everything is accurate. You can get a free copy from each of the three big credit bureaus—Equifax, Experian, and TransUnion—once a year. Look for any mistakes or signs of identity theft, like accounts you didn’t open or debts you don’t recognize.

Building credit responsibly means using credit wisely. That means paying your bills on time, not maxing out your credit cards, and only borrowing what you can afford to pay back. These habits can help you build a good credit history and improve your credit score over time.

Exploring Student Banking Options

At 17 or 18 years old, you might never have thought about a bank. You might have a vague idea about banking, since your parents probably have a bank account. Maybe they even set up a savings account for you.

But now your bank account is yours, and unfortunately, you have to think about it now. College students should care about their bank account for several reasons:

- Managing Expenses: A bank account helps students manage their day-to-day expenses. With a checking account, they can easily pay for groceries, rent, textbooks, and other necessities without relying solely on cash.

- Security: Keeping money in a bank account is much safer than carrying cash. If cash is lost or stolen, it’s gone for good. But if a debit card linked to a bank account is lost or stolen, the funds can often be recovered or the card can be canceled to prevent unauthorized transactions.

- Convenience: Having a bank account offers convenience in managing finances. Online banking allows students to check their account balances, transfer money, pay bills, and deposit checks from their phone or computer, saving time and hassle.

- Building Credit: Many college students may need to borrow money in the future, whether it’s for a car loan, renting an apartment, or buying a house. Having a bank account and responsibly managing it can help build a positive credit history, which is essential for obtaining loans and favorable interest rates in the future.

- Financial Education: Opening and managing a bank account provides valuable financial education. Students learn about concepts like budgeting, saving, and the importance of managing money responsibly, setting them up for financial success in the long run.

Overall, a bank account is a tool. It’s what you use to manage you finances, protect your money, and build a strong foundation for your financial future.

Selecting the right bank account is a big deal for college students who want to manage their money wisely. Here’s what to think about:

- Student checking accounts: These are tailor-made for students. They usually come with perks like no monthly fees, low minimum balances, and easy access to ATMs. Look for a bank or credit union that offers these kinds of accounts.

- Online banking: Going digital can make handling your money a breeze. With online banking, you can deposit checks using your phone, pay bills online, and even use tools to track your spending. Check out what online features different banks offer to see what suits you best.

- ATM accessibility: Having plenty of ATMs nearby is super handy, especially when you’re on campus. Look for a bank with a wide ATM network close to your college to avoid extra fees when you need to get cash.

By picking the right banking option, you can make managing your money simpler and avoid unnecessary fees. Take your time to explore your choices and find the account that fits your needs best.

Building an Emergency Fund

Building an emergency fund is like having a safety net for your finances. It’s there to help you out when unexpected expenses pop up, giving you peace of mind in tough situations. Here’s how you can start building one:

- Set Savings Goals: Figure out how much you need to save – at least three months of living expenses is good.

- Start Small: You don’t have to save up your emergency fund all at once. Start by setting aside a small amount of money from each paycheck, even if it’s just a few dollars.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account on payday. This way, you won’t even have to think about it—the money will be put aside for your emergency fund before you have a chance to spend it.

By following these steps, you can start building an emergency fund to protect yourself from financial emergencies and unexpected expenses. Remember, it’s not about how much you save at once, but about making saving a regular part of your financial routine. Over time, your emergency fund will grow, giving you greater financial security and peace of mind.

Avoiding Common Financial Pitfalls in College

Avoiding common financial pitfalls is one of those essential money skills for college students to maintain financial stability and avoid unnecessary stress. Here’s a deeper dive into some of these pitfalls and how to steer clear of them:

Overspending: It’s easy to get caught up in the excitement of college life and overspend on non-essential items like dining out, entertainment, or trendy gadgets. However, overspending can quickly drain your bank account and leave you struggling to cover essential expenses.

Credit Card Debt: Credit cards can be a convenient way to make purchases, but they can also lead to high-interest debt if not used responsibly. Avoid carrying balances on your credit cards whenever possible, since the interest charges add up and make it harder to pay off your debt. If you do use credit cards, pay your balances in full each month to avoid interest charges and only charge what you can afford to pay back.

Impulse Purchases: Impulse purchases can derail your budget. Almost half of all college students with credit card debt in 2023 admitted it was because of impulse buying. Before you buy, stop a second. Ask yourself if it’s something you truly need or if it’s just something you want for now and will regret later. By practicing mindful spending and resisting impulse purchases, you can avoid wasting money on unnecessary items and stay on track with your financial goals.

By being aware of these common financial pitfalls and taking proactive measures to avoid them, college students can establish healthy financial habits and set themselves up for long-term financial success.

FAQs

Staying financially stable in college means having a plan. Keep that plan simple – no get rich quick schemes or risky investments. Go with what works:

• Make a Budget: Keep track of what you earn and spend. Plan for your college expenses like tuition, books, and food.

• Cut Costs: Find ways to spend less money. Buy used books, cook at home instead of eating out, and share living expenses with roommates.

• Earn Money: Get a part-time job or look for work-study programs. Choose jobs that fit with your class schedule.

• Apply for Aid: Apply for scholarships, grants, and loans to help pay for college. Fill out forms like the FAFSA to see what aid you qualify for.

• Save Smart: Save some money for emergencies, like unexpected bills. Also, start saving for future goals, like grad school or a trip.

• Get Help: Take advantage of resources at your college for financial advice. Learn about managing money and planning for your future.

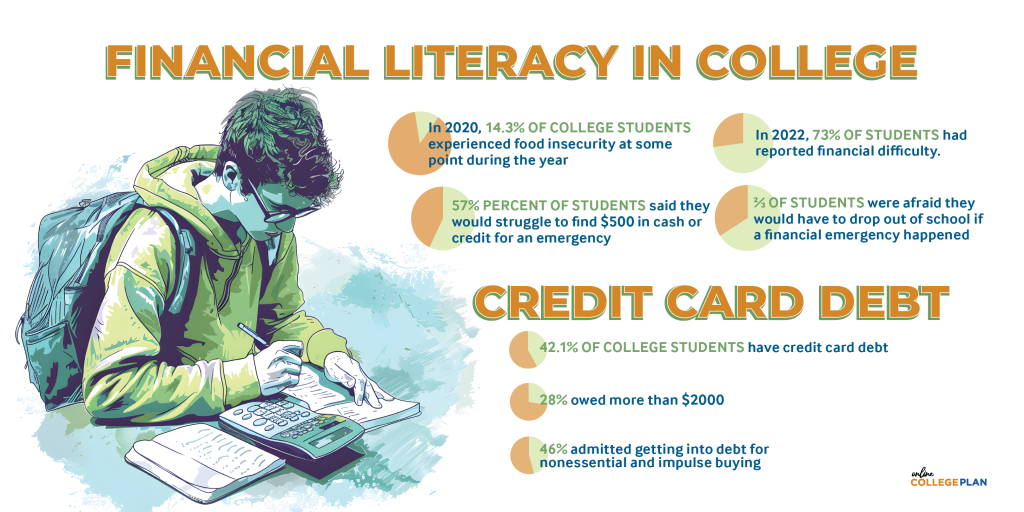

Many college students have money problems. Research shows that a lot of students find it hard to pay for things like tuition, books, and housing. Look at the stats:

• In 2020, 14.3% of college students experienced food insecurity at some point during the year (Hopewell Foundation, 2020).

• In 2022, 73% of students had reported financial difficulty.

• 57% percent of students said they would struggle to find $500 in cash or credit for an emergency

• ⅔ of students were afraid they would have to drop out of school if a financial emergency happened

This happens because college costs are going up, and sometimes financial aid isn’t enough to cover everything. Also, working part-time might not bring in enough money, so some students end up borrowing money or facing tough financial situations. Basically, a bunch of college students have a tough time with money, which is why it’s important for colleges to offer support and help students manage their finances better.

The media talks a lot about college graduate and student loan debt. But many students start accumulating debt well before graduation:

• 43.3% of first-time, full-time students borrowed federal student loans in 2020-2021, with an average annual borrowing amount of $6,501 (National Center for Education Statistics, 2023).

This means some students may have multiple years of debt accumulation before graduating.

A U.S. News & World Report survey found:

• 42.1% of college students have credit card debt

• 28% owed more than $2000

• 46% admitted getting into debt for nonessential and impulse buying

The good news in that survey – credit card debt had actually gone down from the previous year. The bad news – it’s that banks and other lenders had tightened up credit because of low credit scores and high debt.

Managing money stress in college can be tough, but you’re not alone! Preventing money problems is the single best way to manage your stress. Here are some tips to help you navigate this common challenge:

• Awareness and Budgeting: Track your spending, Create a budget, and Set realistic goals

• Building Financial Resilience: Explore income options, Apply for scholarships and grants, and Negotiate bills

• Developing Healthy Habits: Compare prices, Limit impulse purchases, and Seek support

• Taking Care of Yourself: Prioritize mental health, Avoid unhealthy coping mechanisms, and Celebrate small wins

Determining the exact number of people who don’t pursue college solely due to money is challenging, as individual reasons are often complex and multifaceted. However, several studies and surveys shed light on the significant impact cost plays in educational decisions:

• Money is the biggest reason why adults without a degree haven’t enrolled in post-secondary education: 55% of respondents cited program costs as a “very important” reason (Money, 2023).

• Affordability concerns are rising: 45% blamed concerns about affordability due to inflation for not enrolling (Money, 2023).

• 34% of young adults who aren’t currently enrolled say it’s a “waste of money”: This points to potential financial discouragement, though other factors might be involved (Intelligent, 2023).

While an exact number isn’t available, financial concerns undoubtedly play a significant role in many individuals’ not pursuing college. Addressing accessibility through financial aid reform, affordability initiatives, and promoting awareness of various educational pathways can help bridge this gap and ensure wider access to higher education.