Find your degree

If you don’t have experience – or someone to guide you – navigating college financial aid can feel like it’s written in code. Understanding the ins and outs of financial aid is crucial to making it through college. In this guide, we’ll break down the essential components of financial aid packages, helping you decode the terminology, calculate costs, seek additional aid, and plan for unexpected expenses.

Disclaimer: Online College Plan does not provide financial guidance. This article is for informational purposes only and should not be considered financial advice. All data and statistics were current at time of publication.

Financial Aid Basics: Grants, Loans, and Scholarships

When I went to college as a first-generation student from a working-class family, I knew nothing about financial aid – and no one could explain it to me. If you’re in the same boat, and need help deciphering financial aid offers Online College Plan is here for financial aid package decoding!

Let’s break it down into three main parts: grants, loans, and scholarships.

- Grants: Free money awarded based on financial need or merit. Examples include Pell Grants and state-specific grants.

- Loans: Borrowed money that must be repaid with interest. Know the difference between federal and private loans, and their repayment terms.

- Scholarships: Merit-based awards given for academic, athletic, or extracurricular achievements.

Grants are like gifts – they’re free money given to students who show financial need or do well academically. Examples include Pell Grants and grants from your state. They’re super helpful because you don’t have to pay them back, making college more affordable for you and your family.

Now, loans are a bit different. They’re like borrowing money that you have to pay back later, with interest. There are two main types: federal loans and private loans. Federal loans usually have lower interest rates and better repayment plans, while private loans might give you more money but can be stricter. It’s important to understand the terms before deciding.

Lastly, scholarships are like rewards for doing well. They’re based on things like good grades, sports achievements, or community service. You can find them from your college, outside organizations, or even local businesses. Scholarships can help cover your college costs, and like grants, they don’t have to be paid back.

| Loans | Grants | Scholarships |

|---|---|---|

| Not need-based | Based on financial need | May be based on need |

| Must be repaid | Do not need to be repaid | Do not need to be repaid |

| Federal or private | Federal, state, or private | Federal, state, or private |

Calculating the True Cost of Attendance: What Does College Really Cost?

When you pack your bags and head off to college, don’t be surprised by the expenses along the way. Let’s break down the true cost of attendance into five main categories:

- Tuition and Fees: Understand the costs charged by the college or university.

- Room and Board: Consider housing and dining expenses.

- Books and Supplies: Estimate costs for required materials.

- Transportation: Account for travel to and from campus.

- Miscellaneous Expenses: Include personal expenses and entertainment.

Tuition and Fees:

The big one – tuition and fees cover the cost of your classes and any other mandatory charges from the college or university. This is where most of your money goes, so it’s essential to know exactly what you’re paying for and if there are any additional fees, like lab fees or technology fees.

Room and Board:

Where you live and what you eat can also impact your college expenses. Room and board include the cost of housing – whether you’re living in a dormitory, apartment, or off-campus housing – as well as dining expenses. Consider factors like meal plans and whether you’ll be cooking your own meals to get a clear picture of these costs.

Books and Supplies:

You can’t forget about the textbooks and other materials you’ll need for your classes. Textbooks can be expensive, so it’s essential to budget for them. Don’t forget about other supplies like notebooks, pens, and even a laptop if you need one for your studies.

Transportation:

Getting to and from campus can add up, especially if you’re commuting or living far away from home. Consider the cost of gas, public transportation, or parking permits if you’ll be driving. Don’t forget about travel expenses during breaks and holidays if you’ll be going home or traveling elsewhere.

Miscellaneous Expenses:

Last but not least, don’t forget about all the little things that can add up over time. Personal expenses like toiletries, laundry, and clothing are easy to overlook but can quickly eat into your budget. And of course, there’s entertainment – whether it’s going to movies, eating out with friends, or attending campus events, it’s essential to budget for some fun too.

By breaking down the true cost of attendance into these five categories, you can get a better understanding of what it will take to afford college. It’s not just about tuition – it’s about all the expenses that come with being a college student. So take the time to plan and budget accordingly, and you’ll be better prepared for the road ahead.

What are Some Other Financial Aid Opportunities?

When it comes to understanding college financial aid, sometimes the initial financial aid package isn’t enough to cover all your expenses. That’s where seeking additional financial aid opportunities comes in. Let’s explore four avenues to bolster your financial aid package:

- FAFSA (Free Application for Federal Student Aid): Complete this form to determine eligibility for federal aid, including grants, loans, and work-study programs.

- CSS Profile: Some colleges require this additional financial aid application, providing a more detailed picture of your financial situation.

- Institutional Aid: Explore scholarships and grants offered directly by the college or university.

- External Scholarships: Research opportunities from organizations, foundations, and businesses.

So what do each of these things actually mean?

FAFSA (Free Application for Federal Student Aid):

The FAFSA is your gateway to federal financial aid, including grants, loans, and work-study programs. By completing this form, you provide information about your family’s income and assets, which is used to determine your eligibility for various types of aid.

Grants like the Pell Grant, loans such as the Direct Subsidized and Unsubsidized Loans, and work-study opportunities can all be accessed through the FAFSA. It’s essential to submit your FAFSA as early as possible to maximize your chances of receiving aid.

CSS Profile:

While the FAFSA is required by all colleges and universities for federal aid, some institutions also require the CSS Profile for a more detailed assessment of your financial situation.

Unlike the FAFSA, the CSS Profile takes into account additional factors such as home equity and noncustodial parent income.

By completing the CSS Profile, you provide colleges with a comprehensive view of your financial need, potentially increasing your eligibility for institutional aid.

Institutional Aid:

Many colleges and universities offer their own scholarships and grants directly to students. These institutional aid opportunities may be based on academic achievement, extracurricular involvement, or other criteria determined by the institution.

By researching and applying for institutional aid, you can tap into additional sources of funding specific to your chosen college or university.

External Scholarships:

Beyond federal and institutional aid, there are countless external scholarship opportunities available from organizations, foundations, and businesses. These scholarships may be merit-based, need-based, or tied to specific fields of study or demographic groups.

By actively seeking out and applying for external scholarships, you can further supplement your financial aid package and reduce the overall cost of your education.

By exploring these additional financial aid opportunities, you can maximize your chances of securing the funding you need to pursue your college dreams. Whether it’s through federal aid, institutional scholarships, or external grants, taking a proactive approach to financial aid can help make higher education more accessible and affordable.

Understanding Work-Study Programs

Many students offset their college expenses with work-study programs. What is work-study?

Federal Work-Study

Federal Work-Study (FWS) offers part-time employment opportunities for students with demonstrated financial need. Through FWS, eligible students can secure on-campus or off-campus jobs, allowing them to earn money to help cover educational expenses.

These jobs may involve work in various departments on campus, such as administrative offices, libraries, or academic departments. The earnings from FWS positions are typically subsidized by the federal government, so colleges get paid back for hiring you!

There are many jobs on a college campus that need to be done, and many of them are done by students on work-study. Some examples include:

- Administrative Assistant: Providing clerical support in offices, such as answering phones, filing paperwork, and assisting with data entry.

- Tutor: Assisting fellow students with coursework in subjects like math, writing, or foreign languages.

- Library Assistant: Shelving books, assisting patrons with research, and managing circulation desks.

- Lab Assistant: Assisting professors or researchers in laboratory settings by preparing materials, conducting experiments, and cleaning equipment.

- Resident Assistant (RA): Supporting students living in dormitories by organizing events, enforcing rules, and providing guidance and support.

- Fitness Center Attendant: Monitoring fitness center activities, enforcing rules, and assisting patrons with equipment.

- Dining Hall Worker: Serving food, cleaning tables, and assisting with food preparation and storage in campus dining facilities.

- Event Staff: Assisting with setup, cleanup, and coordination of campus events, such as concerts, lectures, and conferences.

- Research Assistant: Assisting faculty members with research projects by conducting literature reviews, collecting data, and analyzing findings.

Work-study programs offer valuable opportunities for students to earn money while pursuing their education. Whether through Federal Work-Study or other employment options, students can gain valuable skills, contribute to their financial well-being, and enhance their overall college experience.

On-Campus vs Off-Campus Jobs

When considering work-study opportunities, it’s essential to weigh the benefits of on-campus versus off-campus employment. On-campus jobs offer several advantages, including convenient scheduling that accommodates your class schedule and extracurricular commitments.

Additionally, working on campus allows you to build connections with faculty, staff, and fellow students, fostering a sense of community and belonging. Moreover, on-campus positions may provide valuable career-related experience relevant to your field of study, enhancing your resume and skill set.

On the other hand, off-campus employment offers a different set of advantages. Off-campus jobs may provide a wider range of employment opportunities, allowing you to explore industries outside of the university setting. Additionally, off-campus jobs may offer higher wages or opportunities for career advancement, depending on the nature of the position. However, it’s essential to consider factors such as transportation costs and commute time when weighing the pros and cons of off-campus employment.

Planning for Unexpected Expenses

Almost one in four American adults – 22% – have no emergency funds saved. Think about it – that’s a quarter of us living paycheck to paycheck, who could be ruined by one bad break.

Don’t be one of them. Even if you have your parents or someone else to fall back on as a young adult, college is a good time to start practicing.

Emergencies can strike at any time, whether it’s a sudden medical expense, car repair, or unexpected trip home, having an emergency fund provides a financial safety net. Here’s how you can proactively plan for emergencies:

- Set aside money specifically designated for unexpected costs.

- Aim to save enough to cover at least three months’ worth of living expenses.

- Save intentionally – set aside the same amount every month and pretend you never had it

- Stay in your budget so you can roll with surprise expenses

Colleges and universities offer a variety of student support services and resources to help students navigate financial challenges. Take advantage of these resources, including:

- financial aid counseling

- budgeting workshops

- emergency assistance programs

Don’t hesitate to reach out for support – you’re not alone in facing financial challenges, and help is available when you need it most.

By proactively planning for emergencies, budgeting wisely, and utilizing available resources, you can build financial resilience and navigate life’s unexpected twists and turns with confidence. While emergencies may be unavoidable, your preparedness and proactive approach to financial management will help you weather the storm and emerge stronger on the other side.

FAQs

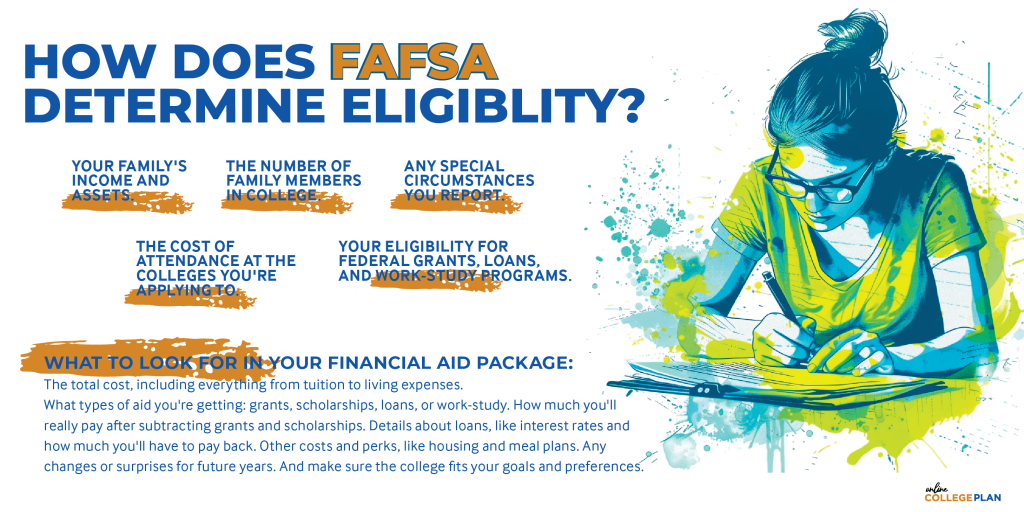

Are you in the lucky position of being accepted into more than one college? Then you might wonder how to compare their financial aid packages. Obviously, you want the one that has the most advantages for you. These are the things to look for when you’re interpreting financial aid packages:

• The total cost, including everything from tuition to living expenses.

• What types of aid you’re getting: grants, scholarships, loans, or work-study.

• How much you’ll really pay after subtracting grants and scholarships.

• Details about loans, like interest rates and how much you’ll have to pay back.

• Other costs and perks, like housing and meal plans.

• Any changes or surprises for future years.

• And make sure the college fits your goals and preferences.

There are ways to get a better financial aid package. Obviously, there are limits to how much you can improve your FAFSA results or cut expenses in college.

But to get the best financial aid package for you:

• Fill out the FAFSA early.

• Apply for scholarships.

• Be honest about your financial situation.

• Talk to the financial aid office.

• Keep your grades up.

• Consider cheaper colleges.

• Compare offers and negotiate.

Cracking the financial aid code can be challenging, especially if you’re the first in your family to go to college. Here are some simple steps to understanding your offer.

• Start by completing the FAFSA (Free Application for Federal Student Aid) form online.

• After you submit your FAFSA, colleges will use the information to determine your financial aid eligibility.

• Review your financial aid offers carefully. They typically detail the types of aid you’re eligible for, such as grants, scholarships, loans, and work-study programs.

• Contact the financial aid office at each college for on your package. That’s their job!

• Compare the offers from different colleges to see which one provides the best combination of aid to help cover your costs.

FAFSA determines your financial aid eligibility based on:

• Your family’s income and assets.

• The number of family members in college.

• Any special circumstances you report.

• The cost of attendance at the colleges you’re applying to.

• Your eligibility for federal grants, loans, and work-study programs.

The main way to know how much financial aid you can get is through FAFSA.

The Department of Education offers a very handy estimator that will give you an idea of your Estimated Family Contribution and other factors.